Renters Insurance in and around Piedmont

Renters of Piedmont, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Piedmont

- Greenville

- South Carolina

- Georgia

- North Carolina

- Fountain Inn

- Easley

- Powdersville

- Honea Path

- Anderson

- Williamston

- Pelzer

- Laurens

- Ware Shoals

Calling All Piedmont Renters!

No matter what you're considering as you rent a home - outdoor living space, utilities, furnishings, condo or townhome - getting the right insurance can be crucial in the event of the unanticipated.

Renters of Piedmont, State Farm can cover you

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

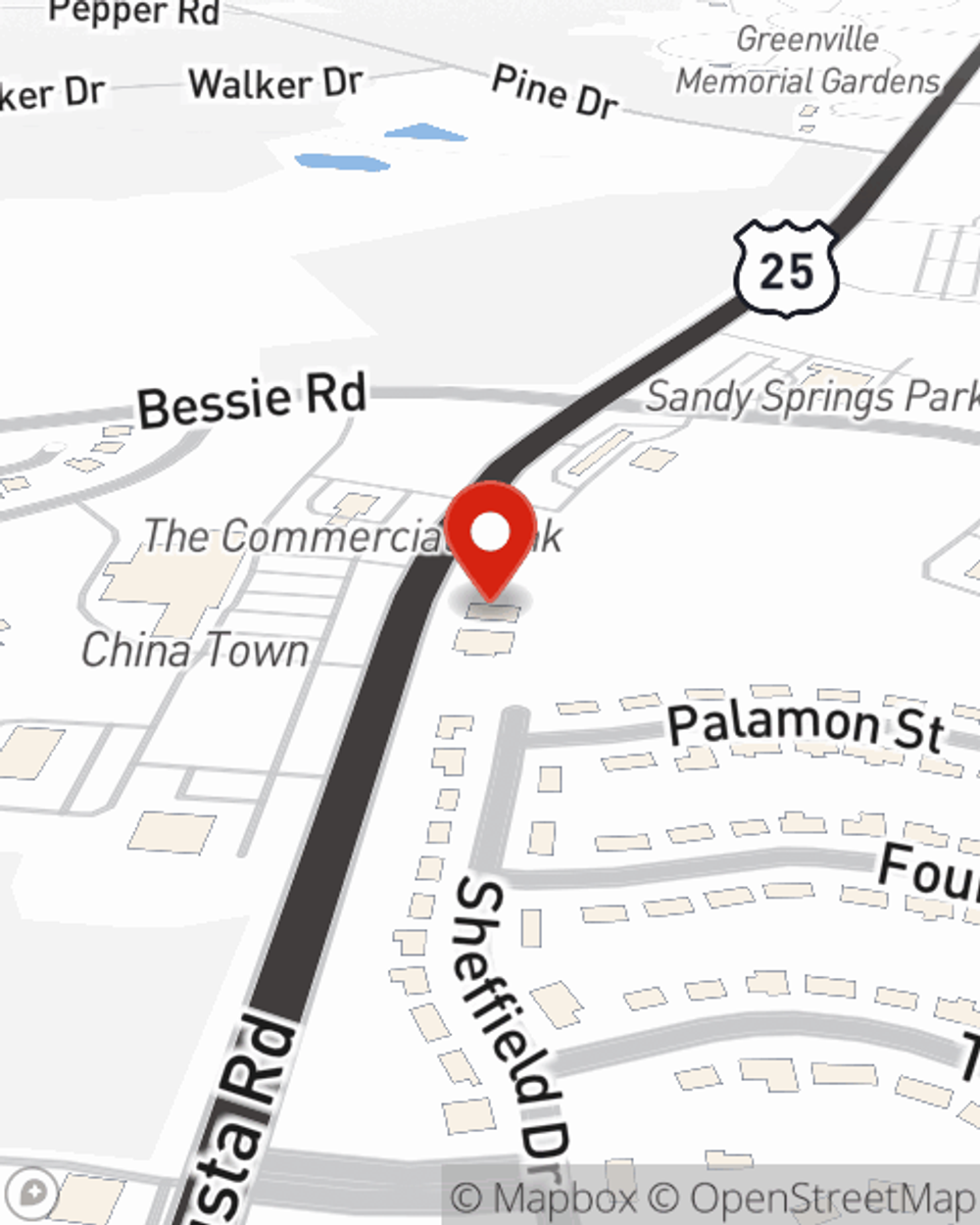

When the unexpected fire happens to your rented townhome or apartment, usually it affects your personal belongings, such as a video game system, a microwave or a bicycle. That's where your renters insurance comes in. State Farm agent Mike Livesay has a true desire to help you evaluate your risks so that you can protect yourself from the unexpected.

It's always a good idea to make sure you're prepared. Visit State Farm agent Mike Livesay for help understanding savings options for your rented home.

Have More Questions About Renters Insurance?

Call Mike at (864) 299-5006 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Mike Livesay

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.